When it comes to invest in physical silver, there are several aspects to ownership like taxes, storage, protection, and more that you’ll want to be aware of.

It can be a great decision for some to diversify their portfolio with physical silver, but for others another precious metal may be a better option.

So, in this article we are going to cover all of the fundamental aspects of investing in physical silver to keep you informed!

Quick Disclaimer:

The content provided in this article is for informational purposes only and should not be considered financial or investment advice. Always consult with a qualified financial advisor before making any decisions regarding Precious Metals, Investing, or IRAs. Additionally, this article contains affiliate links, and I may earn a commission if you make a purchase through these links, at no additional cost to you.

Another question, I have been asked is, “What Gold IRA companies are the best” or “Which IRA companies are the most trusted?”.

If you’d like more information, below is a link to a comparison PDF by Augusta Precious Metals that could be useful. (It’s also free.)

Augusta Gold IRA Company Integrity Checklist

Benefits of Silver

Silver offers several advantages as an investment:

- Hedge Against Inflation: Silver has historically shown an ability to retain purchasing power during periods of rising prices (AU Precious Metals).

- Industrial Demand: Silver’s applications in electronics, renewable energy technologies, and other industries contribute to its demand and price dynamics (U.S. News).

- Potential for High Returns: Silver reached an all-time high of $49.51 in April 2011, showcasing its potential for significant earnings (AU Precious Metals).

- Wealth Preservation: Although it’s volatile, silver can provide a cushion against declines in purchasing power over the long term.

Comparing to Other Investments

When comparing silver to other investments like stocks, bonds, and other precious metals, it’s essential to examine the unique attributes and benefits each offers.

| Investment Type | Key Benefits | Risks |

|---|---|---|

| Silver | Hedge against inflation, industrial demand, potential for high returns | Market volatility, theft |

| Gold | Safe haven, hedge against inflation, high liquidity | Higher price per ounce, storage costs |

| Stocks | Capital appreciation, dividends | Market volatility, economic downturns |

| Bonds | Fixed income, lower risk | Interest rate risk, inflation risk |

| Real Estate | Tangible asset, rental income | High entry cost, market fluctuations |

Silver stands out due to its dual role as both an industrial metal and a store of value.

This makes it different from gold, which primarily serves as a store of value.

Additionally, silver’s industrial applications contribute to its demand and price dynamics, making it a versatile asset in your investment portfolio.

For more insights into diversifying with precious metals, you can explore our articles on investing in physical gold, investing in platinum, and investing in palladium.

How to Buy Silver

Coins vs. Bars

Coins:

Silver coins are popular among investors for their government-backed authenticity and liquidity.

The most popular choices include 1oz rounds, Silver Eagles, Canadian Maple Leafs, and Austrian Philharmonics.

| Coin Type | Weight | Purity | Face Value |

|---|---|---|---|

| Silver Eagle | 1 oz | 99.9% | $1 |

| Canadian Maple Leaf | 1 oz | 99.99% | $5 |

| Austrian Philharmonic | 1 oz | 99.9% | €1.50 |

Pros:

- Easily recognizable and trusted

- High liquidity

- Smaller denominations for flexibility

Cons:

- Higher premiums over spot price

- Potentially greater storage space required compared to bars

Bars:

Silver bars, ranging from 1-ounce to 100-ounce sizes, are another common investment.

They are typically 99.9% pure silver and are favored for their low premiums over the spot price (U.S. News).

| Bar Size | Weight | Purity | Premium Over Spot Price |

|---|---|---|---|

| Small Bar | 1 oz | 99.9% | Low |

| Medium Bar | 10 oz | 99.9% | Lower |

| Large Bar | 100 oz | 99.9% | Lowest |

Pros:

- Lower premiums compared to coins

- Efficient storage for large quantities

Cons:

- Less liquid compared to coins

- Larger denominations may not be ideal for smaller transactions

Junk Silver and Numismatics

Junk Silver:

Junk silver refers to coins that contain silver but have no collectible value.

Common examples include pre-1965 US dimes, quarters, and half-dollars. These coins are typically 90% silver (U.S. News).

Pros:

- Often sold close to the spot price

- Smaller denominations for flexibility

- Easy to recognize and verify

Cons:

- Can have high premiums during times of high demand

- Less aesthetically pleasing compared to bullion coins

Numismatic Coins:

Numismatic coins are valued not just for their silver content but also for their rarity and historical significance.

These coins can potentially appreciate in value more than regular bullion due to their collectible appeal.

Pros:

- Potential for significant appreciation in value

- Historical and aesthetic appeal

- Often easier to buy and sell in regions with a rich numismatic history

Cons:

- Higher premiums and greater initial investment

- Requires expertise to assess true value

- Less suitable for pure silver content investment

When investing in silver coins or investing in bullion, understanding the differences between these forms of silver can help you make informed decisions.

Each type has its own advantages and drawbacks, so choose the one that aligns with your investment goals and storage capabilities.

For a broader look into precious metals investing, explore our additional resources.

Storing Your Silver

Storage Options

There are several options for storing your silver, depending on your preferences and security needs.

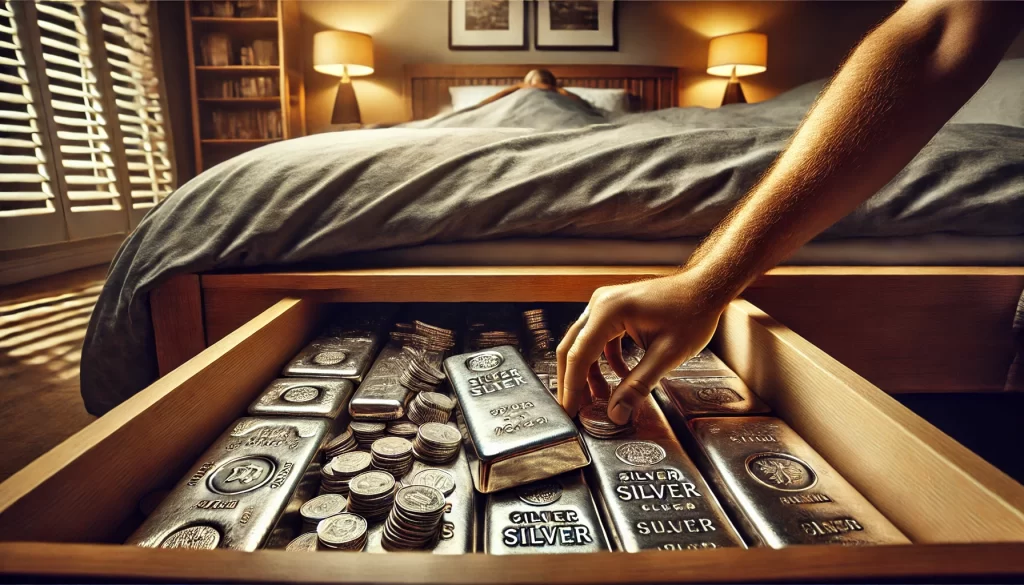

Home Storage

Home storage involves keeping your silver within your residence.

This option provides easy access to your silver, but it also carries higher risks.

Homeowners or renters insurance typically covers only a small portion of precious metal holdings, so extra precautions are necessary.

Safe Deposit Box

A safe deposit box at a bank is another option.

This method provides high security and protection from theft and damage.

However, accessing your silver may be less convenient, especially during bank holidays or emergencies.

Professional Storage

Professional storage facilities offer secure and insured storage for your silver.

These facilities are specifically designed to store precious metals and provide various levels of security.

This option might come with storage fees but ensures maximum protection.

| Storage Option | Pros | Cons |

|---|---|---|

| Home Storage | Easy access | Higher risk of theft |

| Safe Deposit Box | High security | Limited access |

| Professional Storage | Maximum protection, insured | Storage fees |

Security Tips

Regardless of the storage option you choose, implementing security measures is essential to protect your silver investment.

Use a Safe

If you prefer home storage, invest in a high-quality safe.

Choose a safe that is fireproof, waterproof, and heavy enough to deter theft.

Anchoring the safe to the floor or wall adds an extra layer of security.

Discreet Storage

Avoid advertising your silver holdings.

Keep your investment discreet and limit the number of people who know about it. This reduces the risk of targeted theft.

Diversify Storage Locations

Consider diversifying your storage locations.

Splitting your silver between home storage, a safe deposit box, and professional storage facilities can minimize the risk of losing your entire investment in a single incident.

Insurance

Ensure that your silver is insured.

While homeowners or renters insurance may not cover the full value, specialized insurance policies for precious metals can provide adequate coverage.

For more information on securing your investment in silver, check out our articles on investing in precious metal storage and investing in precious metals.

Risks of Investing

Market Volatility

Silver is known for its market volatility.

The price of silver can experience significant fluctuations due to various economic factors.

For instance, during the Great Recession of 2008-2009, silver prices dropped over 40%, highlighting its susceptibility to economic downturns (Physical Gold).

To mitigate risks associated with market volatility, investors should limit their exposure to silver to under 10% of their total investable assets.

Maintaining a diversified portfolio is critical for managing risk and ensuring financial stability.

Theft and Liquidity

Storing physical silver poses security risks.

Homeowners or renters insurance typically covers only a small portion of precious metal holdings, necessitating careful consideration of storage options.

Investors should be cautious of overpaying for physical silver and should be aware of the risks associated with theft and the liquidity of their investment.

Storing silver in a secure location, such as a safe deposit box or a specialized storage facility, can help mitigate these risks.

Additionally, liquidity can be a concern for physical silver investors.

Unlike stocks or bonds, silver cannot be easily converted to cash without physical transfer.

This can complicate the process of selling your investment quickly when needed.

| Risk Factor | Description |

|---|---|

| Market Volatility | Significant price fluctuations due to economic factors; silver prices dropped over 40% during the Great Recession. |

| Theft | Security risks associated with storing physical silver; limited insurance coverage for precious metals. |

| Liquidity | Difficulty in quickly converting physical silver to cash; involves physical transfer. |

By being aware of these risks, you can make informed decisions about investing in physical silver.

For more information on securing your investments, visit our article on investing in precious metal storage.

Additionally, consider exploring other precious metals investing options to further diversify your portfolio.

Silver in Your Portfolio

Diversification Strategies

Investing in physical silver provides a hedge against inflation and adds diversity to your investment portfolio.

Diversification helps spread risk across different asset classes, reducing the impact of any single investment’s poor performance.

By including silver in your portfolio, you can benefit from its historically demonstrated ability to retain purchasing power during periods of rising prices.

Experts recommend diversifying within commodities, including silver, to achieve a well-rounded portfolio.

Commodities as a whole should make up about 5% of your portfolio, ensuring you are not overly exposed to any one type of investment (U.S. News).

This approach helps protect against market volatility and economic declines.

Allocating Silver

When allocating silver in your investment strategy, it’s crucial to consider the proportion of silver relative to your total investable assets.

Financial advisors often suggest limiting your exposure to silver to under 10% of your total assets (Physical Gold).

This conservative allocation minimizes risks while still providing the benefits of silver investment.

| Allocation Type | Recommended Percentage |

|---|---|

| Commodities (including silver) | 5% |

| Silver | <10% |

A balanced portfolio might include a mix of stocks, bonds, real estate, and precious metals.

Silver can complement other precious metals such as gold, platinum, and palladium, providing a robust defense against inflation and market fluctuations.

For those new to silver investing, starting with silver coins or bullion can be a practical choice.

These forms of silver are easy to buy, sell, and store, making them accessible for beginners.

If you are interested in diversifying further, consider exploring numismatic coins or collectible coins.

By carefully allocating silver in your investment portfolio, you can enjoy the benefits of diversification while maintaining a secure and balanced financial strategy.

For additional insights and tips, visit our articles on investing in precious metals and silver investing.

Tax Considerations

Capital Gains Tax

When you sell physical silver, the profit you make is subject to capital gains tax.

This tax rate is different from other investments and is an important consideration for those looking to diversify their wealth with precious metals.

According to AU Precious Metals, the capital gains tax on profits from selling physical silver held for more than one year is 28%.

This rate is higher than the long-term capital gains tax rates for most other investments, which typically range from 0% to 20%.

| Holding Period | Tax Rate |

|---|---|

| Less than 1 year | Your ordinary income tax rate |

| More than 1 year | 28% |

This higher tax rate makes it essential to plan your sales carefully and consider the long-term implications of your investment.

For more detailed strategies on managing your silver investments, visit our section on investing in precious metals.

Retirement Accounts

You can include physical silver in your retirement portfolio through a self-directed Individual Retirement Account (IRA).

This type of IRA allows you to invest in tangible assets like silver bars and coins, providing a way to diversify your retirement savings.

According to AU Precious Metals, self-directed IRAs offer the flexibility to include various kinds of investments, including physical silver.

When setting up a self-directed IRA for silver, it’s important to follow IRS guidelines to ensure your investments are compliant.

Not all types of silver are eligible; typically, only certain silver coins and bars that meet specific purity standards can be included.

For more information on diversifying your IRA with silver, check out our guide on investing in precious metal IRAs.

Including physical silver in your retirement accounts can offer several benefits:

- Diversification: Silver can act as a hedge against market volatility, adding stability to your retirement portfolio.

- Inflation Protection: Precious metals like silver often retain their value better than paper assets during inflationary periods.

For a comprehensive look at how silver fits into a diversified investment strategy, visit our section on precious metals investing.